A group of eight organisations working together to tackle poverty and financial exclusion has started a Halloween themed campaign to raise awareness about loan sharks.

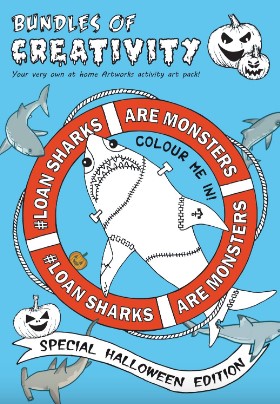

Themed #LoanSharksAreMonsters, the campaign aims to address the rising number of vulnerable residents using illegal lenders in the run-up to Christmas.

The Bradford Anti-Poverty Events Group is led by Bradford District Credit Union and has been made possible through funding from Brelms Trust CIO, Bradford Council and the National Lottery Community Fund.

Artworks Creative Communities has been designing and distributing thousands of booklets every month since May through Food Banks, community groups, schools and partner organisations in APEG.

Deb Collett from Artworks said: “Covid-19 and lockdown has brought increased stress, uncertainty, poverty and isolation to many. We wanted to reach out to families who are digitally excluded and struggling the most, hence involving APEG, Bradford District Credit Union and over 100 community groups spread throughout the entire Bradford District.

“With 10,000 copies sent out, we are really pleased the #LoanSharksAreMonsters edition has proved so popular – it’s a winning formula of creative fun and vital information.”

Ian Brewer, financial inclusion officer for Bradford Credit Union, said: “Loan sharks prey on vulnerable people who need financial help and this manipulative form of lending is often followed by intimidation and threats. Unfortunately, this is something we’re seeing more and more in the area, only recently a loan shark was arrested in Keighley for illegal money lending. Moreover, the government’s Illegal Money Lending Team has suggested that the problem is only getting worse during the pandemic.

“All of this just emphasises the importance of this campaign, our community partnerships and the work of credit unions across the country to provide the right support and options for those who need it most. As such, this working partnership has been essential in driving innovative projects to reach the most financially vulnerable.”

Bradford Anti-Poverty Events Group has been leading other financial inclusion projects as well. In the last year the group was able to reach over 2,000 people through conferences, workshops and road shows around the Bradford District.

Bradford District Credit Union provides affordable financial services as an alternative to high interest lenders. The credit union has also just reached 8,000 members, over doubling in size in the last five years.