Co-operative businesses have been more resilient during the Covid-19 pandemic than traditional businesses, according to the Co-op Economy 2021 report.

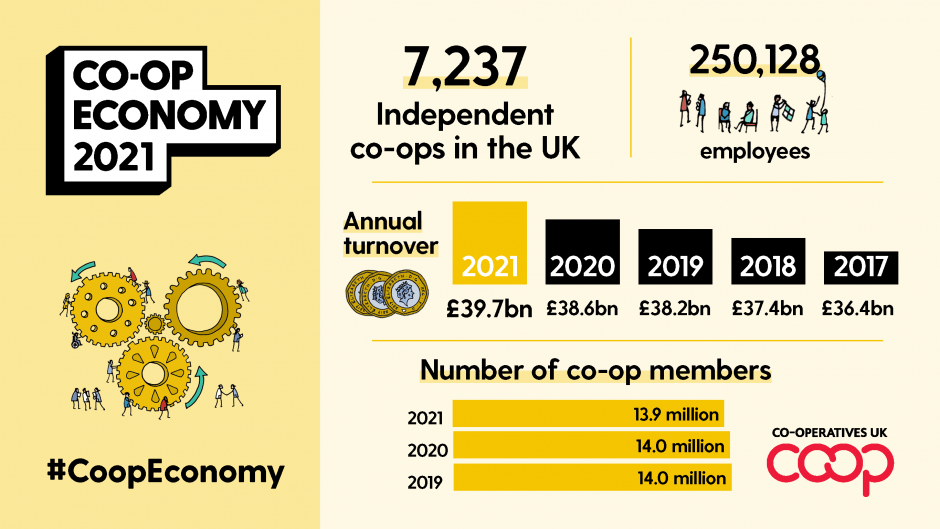

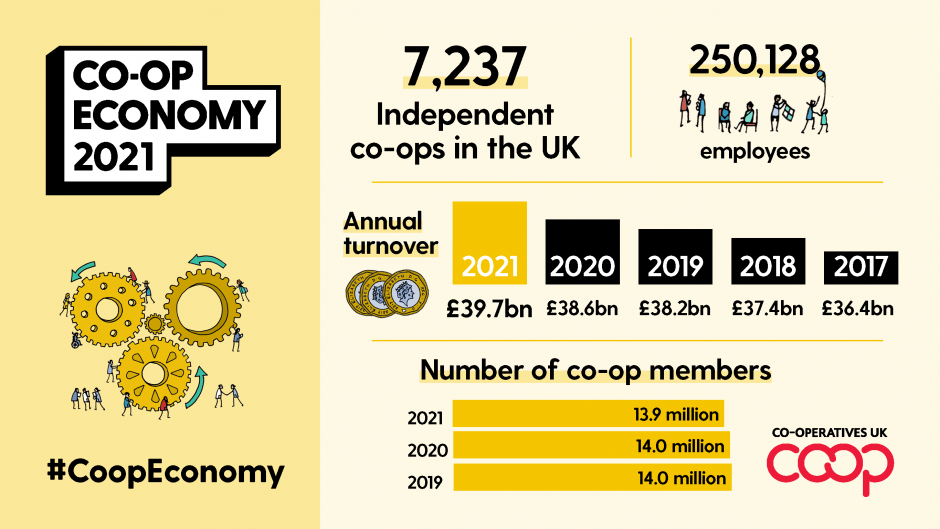

Published by Co-operatives UK on 28 June, the report says just 1.5% of co-ops were dissolved in 2020 compared to 6.5% of businesses generally. Meanwhile, the number of independent co-ops grew by 1.2% during the year, and turnover for the UK’s 7,237 co-ops grew by nearly 3% (£1.1bn) to £39.7bn.

“Why are co-ops so resilient? Because the co-operative purpose, ownership and governance all dictate long-termism,” says Co-operatives UK CEO, Rose Marley. “In an economic shock, it’s the members calling the shots in their collective, long-term interests, not investors making decisions based on short-term returns. Co-ops patiently build-up and reinvest reserves and use members’ capital wherever possible, rather than piling on debt to achieve faster growth.”

It is this ownership model, together with the resilience and sustainability of co-ops that make them a critical part of reducing inequalities in the UK. “It’s fundamentally about ownership,” she says. “People are looking for a stake in the places they live, work and consume and the co-op model distributes this decision-making power.”

In 2020, almost twice as many new co-ops were created as dissolved (193 versus 107). In contrast, the number of UK businesses overall fell, with company closures outstripping new starts (389,965 versus 382,560).

“We are increasingly excited by the growth and interest in what is becoming known as the democratic economy, and co-ops also anchor wealth in local communities, which brings a whole plethora of additional benefits,” adds Ms Marley.

“We’re now calling for more business support to grow this increasingly valuable sector. To have even more impact in terms of levelling up the economy, co-ops need the support that other business models receive as a matter of course. Co-ops have been marginalised and underrated for far too long.”

To address this, the CEOs of nine of the largest retail societies in the UK have jointly written to chancellor Rishi Sunak calling for more tailored business support for co-operatives, catering to their distinct approach to capital raising, business strategy and organisational development.

One of the signatories is Steve Murrells, CEO of the Co-op Group. “If we genuinely want to build back Britain better, but also take the opportunity to build back different, this must be a decade of collective action,” he says.

“The heart of every co-operative has always been the idea that, by coming together, we can all improve our situation, and make sure that nobody gets left behind. It’s something we see adopted by co-operatives across the country, of any size – the government needs to support their future development.”

The number of active members within co-ops fell by 1% from the previous year, but the Co-op Economy Report also highlighted that co-ops are markedly more ambitious than small businesses generally, with 61% of co-ops expressing ambitions to grow/develop in the first quarter of 2021, compared with 53% of small businesses generally.

Co-operatives UK case studies:

Success stories from the UK’s co-operative economy

Crescent Management

Crescent Management is a London-based co-operative actors’ agency (owned and operated by the actors themselves) that’s managed to keep running and even reduce its commissions despite the performing arts industry being decimated by Covid.

The performing arts industry has suffered immeasurably through Covid. As the word lockdown became an everyday term, work for actors vanished overnight. Yet in the midst of the global pandemic a co-operative actors’ agency adapted – and even managed to reduce the commissions it takes.

All 24 carefully selected actors represent by Crescent are also members of the co-op and agents – with each committed to representing the agency. The members were forced to make some tough decisions -–including vacating their London office – when the impacts of Covid struck.

“Work for actors literally fell off a cliff,” said co-op member Emily Outred. “We gave up our office pretty much as soon as Covid hit. We’ve all had tough times. And come next year when a lot of theatres will inevitably go bust the picture will be very different again.”

Decisions were all made for their long-term benefit of the co-op and its members, including reducing the commissions the agency takes. Ms Outred said: “Being a co-op has made a huge difference. Many actors’ agencies have just collapsed. Even if the employees of those agencies had switched to work from homes there’s still salaries to be paid.

“It’s a real democracy here. There’s nothing that’s decided by head honchos. We take joint responsibility for our careers, and we take the time to get to know each other and each other’s work.”

Actors taking more control over their own livelihoods has not met with universal approval. And the members need to buy into the collective ethos. Ms Outred said: “Britain can be very snobby in the entertainment industry. Co-ops are sometimes looked down upon – viewed as being second best to the top agents. That can be problematic.

“It’s a very very competitive business. You have to be selfless here. Whether the competition for roles is within our agency or not – you’d be up against the same people anyway, We’re all trying to get each other into that same room. You have to be ego-less and do what’s best for each other collectively.”

The 24 members of Crescent Management work together in a “massive job share.” Covid has made training new members a trickier process, particularly in terms of the complexity of industry standard software. However, giving members collective responsibility over their careers is proving a win-win.

“Most people come to co-ops for a number of reasons. They want to really understand the business; they want more control. There’s not the pressure from agents to take work – you can say ‘I don’t fancy that’. It’s really empowering. There’s more transparency in what we do. There’s much more freedom.”

The Dewsbury Arcade

Residents in Dewsbury are taking the future of their declining town centre into their own hands by creating the first community-owned shopping centre in the UK.

With beautiful roof ironwork, the arcade in Dewsbury dates back to 1899 and was a popular shopping destination until 2014. A combination of decreasing footfall, poor management and lack of investment saw the arcade empty out and finally close.

Now, plans are afoot to regenerate the arcade by filling it with independent retailers from the town. Residents have formed The Arcade Dewsbury and intend to launch a community share offer in 2021. The aim is to raise £150,000 for the first year’s lease and operating costs.

Chris Hill, a community property developer, is board secretary to the community business, and has been appointed project officer by Kirklees Council with a brief to develop the arcade.

He said: “We want this to be an incubator for retail in the town centre. We want to fill the arcade with independent local businesses, selling everything from bath bombs to cakes, zines and antiques. It will be the first community owned shopping centre in the UK.

“The plan is to go on to lease or buy more empty shops. This is how small towns can come back again; how they can build back from the pandemic, and the years of decline prior to that. You’ve got to get in that community energy that can produce interesting stuff in town centres.”

He and his colleagues – a group of entrepreneurs from Dewsbury – have been working hard behind the scenes with the council, carrying out business planning and lobbying to secure funding to refurbish the building. The plan is for the council to lease the regenerated space to the co-op once renovations are complete.

The Arcade Dewsbury is awaiting confirmation of preferred bidder status, which will give them the green light to go ahead with the share offer. “Forty percent of the population is of South Asian heritage – and we want the arcade to reflect this,” said Mr Hill. “We’ve already had expressions of interest that will guarantee a representative mix of traders. When we come to the share issue, we’re going to be Sharia compliant too.”

Mr Hill is hoping to attract as many local people as possible to invest in the project. He said; “The great thing about a community benefit society is that it keeps money local,. It involves local people in controlling it and keeps wealth within a community. We plan to set up project groups that give members responsibility for new activities like pop-up shops, for example.”

He has developed other community buildings and knows the benefits it can bring. “On a previous project, a woman with little experience got involved and fabulously grew into the senior manager of the trust. Involving local people to take on responsibility empowers individuals – and towns – to realise their potential.”