The World Council of Credit Unions (Woccu) and the Regional Credit Union Center (RCUC) for Central and Eastern Europe hosted a virtual event on 10 May to explore the realities on the ground for credit unions and their members in Ukraine.

Participants heard from Ewa Sierzysnka, chief of party of the Woccu/USAID Credit for Agriculture Producers’ (CAP) Project in Ukraine, who provided an update on the project’s 22 partner credit unions. Some credit unions are not operating due to security issues, she said, while others have staff displaced or missing – with no deaths reported to date.

There is a growing demand for agricultural lending, she added, with many credit unions willing to take risks and farmers keen to continue their work, despite the danger of land mines and problems with a lack of equipment.

Ms Sierzysnka also talked about regulatory burdens for credit unions in safe zones. While there is some flexibility from the regulators regarding loan holidays, some loans are not being repaid, which is causing difficulties for many credit unions. Another challenge is internal displaced of some credit union staff.

Credit unions in Mariupol were among the most affected by the war – and the two Mariupol credit unions involved in the project had their premises bombed.

“Some staff members and directors are missing,” said Ms Sierzysnka. “At this point we cannot talk about operations of any sorts. Right now it’s about finding those people and getting them alive out of the situations.”

Her team has been working with credit unions in Ukraine to help them develop business continuity plans. “The business has to continue [operating],” she said, “so we tried to help our partners to figure out the way to do that.”

Another concern is cybersecurity. Here too, the project helped by finding cloud solutions outside of Ukraine.

USAID and Worldwide Foundation for Credit Unions have recently released the second and final disbursement from a US $1m liquidity fund to help partner credit unions affiliated with the Credit for Agriculture Producers (CAP) Project resume agricultural lending and support food security in Ukraine.

“Out of that tranche, about 65% has been disbursed. There is also the first part of that fund, also revolving, being disbursed. We also see repayments and this is remarkable … from credit unions that are in the combat areas,” she added.

The project will also focus on existing agricultural value chains and making credit unions a partner for smaller producers.

With regards to deposits, Ms Sierzysnka said credit unions have not seen any dramatic outflows. “Some [members] would bring their cash back to credit union and say ‘this is probably safer for me’,” she added.

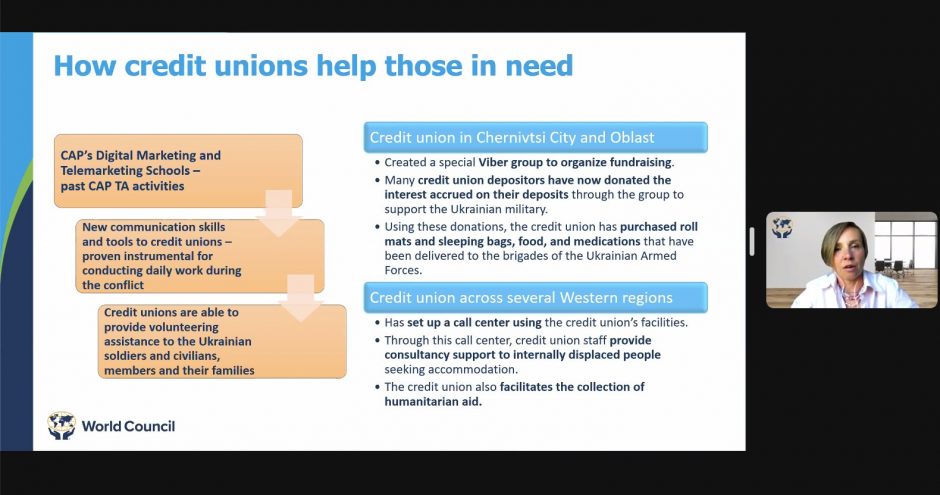

The project also focused on digitisation. This, said Mr Sierzysnka, could help to address the challenges posed by damaged infrastructure and lost contacts. Some credit unions have used the skills gained through the project to provide support in their communities, action as information hubs and running call centres.

“We see that that the work we’ve done, the skills we helped build are there. They’re being used for the best of the communities and Ukraine right now. And I hope for the recovery we can we can continue working with our partners and hopefully restore all the operations.”

Andrew Price, senior vice president of advocacy and general counsel, Woccu, also spoke at the virtual event, providing an overview of Ukraine’s current regulatory framework for credit unions. He explained how prior to the conflict Ukraine had started to bring its banking regulations in line with the EU standards, as part of its EU Association Agreement.

With the regulation of those credit unions moving to the National Bank of Ukraine, Mr Price engaged with bank officials to raise awareness about the credit union model, as member-owned, community-based institution.

Ukraine was also looking at updating credit union legislation, a process that had to be put on hold due to the war. Moving forward Woccu will continue to engage with Ukrainian authorities to promote a lightened regulatory approach to enable credit unions to lend. Woccu will also encourage the Ukrainian regulator to carry out a risk assessment to find out which credit unions suffered significant damage and how those in the most affected areas have been impacted by the conflict.

While he expects the post-war rebuild to be difficult, he thinks digitisation can help credit unions to continue to serve their members. “The idea of a virtual credit union is not that far out of reach,” he said.

Mike Reuter, executive director, Worldwide Foundation for Credit Unions, explained how his organisation is planning to use donations to the Ukrainian credit union displacement fund. Around 35% of the balance will meet immediate term relief; 60% is going to support the long term recovery, reconstruction and rebuilding of credit unions; and 5% will go on overheads and fund administration, marketing and PR.

Pawel Pelc, coordinator, Regional Credit Union Center, talked about the work of Polish credit unions to support Ukraine, from humanitarian relief to welcoming refugees. Many Polish credit unions organised internal fundraising, collection of funds with non-governmental organisations to support Ukraine. For example, SKOK Chmielewskiego credit union organised a collection of goods that were delivered to a church in Lviv hosting injured Ukrainians.

Piotr Palka, head of compliance and legal counsel, NACSCU (Poland) and an alumnus of WYCUP, Woccu’s platform for young credit union professionals, talked about the danger of misinformation spreading across Russia. He encouraged young credit union professionals to take to social media to share information about what is happening in Ukraine and show the true scale of the invasion.