With the UK reeling from a series of crises to hit its economy since the 2008 crash, the need for community development was high on the agenda as the credit union sector gathered for its national conference last weekend.

The event, organised in Manchester by the Association of British Credit Unions (Abcul), opened with a reminder of the sector’s mission to support communities from Bim Afolami, the economic secretary to the Treasury.

The sector is an important one, said Afolami: the 240 credit unions in Britain hold collective assets of over £2.6bn and combined annual revenues of about £88bn in 2022 – 3.5% of the GDP. Saluting “the essential role that credit union credit unions play from fostering financial inclusion to encouraging savings habits and providing affordable loans to their members”, he urged the sector to “redouble your efforts and evangelising about the importance of credit unions, but also encouraging members to join because that’s the only way we’re going to grow in the long term”.

Afolami listed recent government actions support for the sector, including the allocation of £145m in dormant asset funding to initiatives like Fair4All Finance, the pilot Prize Saver scheme and reforms allowing credit unions to offer new services such as hire purchase.

“I strongly encourage you to explore how you can make full use of these powers and factor them into your business strategies,” he said. “They provide an exciting opportunity to diversify your income streams, appeal to new members and enhance operational resilience as organisations.”

He praised steps in this direction including the cloud-native core banking solution from Clockwise Credit Union and the green loan introduced by Hull and East Yorkshire Credit Union.

One way for the sector to meet this purpose is to formalise the community development credit union (CDCU) model. This is already well-established in the US and for several years Abcul has promoted the idea at its conferences, notably with a delegation in 2018 from the leaders of the CDCU federation, now known as Inclusiv.

Related: Credit union apex Abcul charts its performance with member survey

This year, the conference featured a panel discussion from UK credit unions involved in a CDCU pilot project, chaired by Scott Butterfield from US service organisation Your Credit Union Partner.

Butterfield said UK credit unions already “stack up with other countries in terms of the difference you make in people’s lives”.

But he warned: “You have to grow at a healthy rate to generate that extra surplus keep up with tech, keep up with human resources and afford pay future leaders. We need to see UK credit unions grow and prosper and live out their best mission.”

In the US, CDCUs manage this growth, he said, while meeting the government criteria they need gain regulatory flexibility and access to grant funding. Sector regulator NCUA classifies 2,300 of the US’s 4,800 credit unions as CDCUs – meaning they serve areas with low incomes or historically underserved communities, such as black or Asian people. Typically, 30%-50% of a CDCU’s members are not in the prime credit market.

“You have to demonstrate to the Treasury that you are lending in these communities, you have to demonstrate you have a community development mission, and have waterproof strategy of what products and services you offer.” said Butterfield, with designation coming up for renewal on an annual basis.

In return for Treasury support, CDCUs work on financial education, housing and transport, and offer products designed to help people avoid predatory lenders. “Does that sound familiar to anyone?” asked Butterfield of the UK sector. “Does that sound like what you’re doing? We want you to get a little more credit here.”

Grant funding goes to healthy lenders – “they don’t want to give money to a credit union that’s not going to be around in a few years” – and is used to back up a CDCU’s loan loss reserves and capital. The Treasury wants a return on this investment, said Butterfield. “If you can say, you gave us a million, we turned into ten million worth of lending on green energy, development and so on … that is the future I see for UK CDCUs.”

The model is a resilient one, said Butterfield, noting that compared to normal credit unions, CDCUs enjoy a 30-50% higher net surplus, a 25% higher average loan yield and a 26% five-year growth rate (2021 figures).

Lending is vital for this growth, he added. “Credit unions have to invest in members. We have to do risk-taking – not risk-taking is risky. UK credit unions are smaller because they are very savings-deposit focused.”

He added: “If we want to attract the next generation we need a good social platform for them. It seems to me the CDCU platform could help credit unions get the funds they need to leverage.”

Panelits from a CDCU pilot scheme run by Abcul set out lessons they had learned, stressing the need to identify members of the common bond who are not being served, to grow membership and gather evidence to support the case for government funding.

Julie Mallinson, from Celtic CU, said she hoped the pilot will bring “recognition and awareness of what we do – we struggle for that”. She cited Welsh government’s failure to incorporate a “fully worked out programme for financial education in schools”, developed by Celtic eight years ago, into its national curriculum.

“We’re very active in schools and communities,” she said. “If this pilot helps us grow than that’s a good thing.”

There was some concern from the audience as to the availability of government funds during a spending squeeze. In the US, said Butterfield, “accreditation came first; we used it to ask the government for support … You have to tell a story first.

“You are depository institutions, you can leverage grant funding further than any other organisation. Remember you have power and tell your story and you will be more successful than the US model because you are already closer to that CDCU model.”

After the panel, Butterfield attended a breakout session which looked at low-carbon retrofitting, one of the new areas of business where there is scope for credit unions to demonstrate a community development benefit.

Led by Jonathan Atkinson from the People Powered Retrofit co-op, the session looked at efforts to create a “one-stop shop” for credit union members wanting funds to improve the energy efficiency of their properties. For the UK to meet its net zero commitments progress is urgently needed on retrofit, he said, with a number of barriers to overcome – from homeowners being wary of rogue traders to the reluctance of banks to lend for energy efficiency upgrades.

People Powered Retrofit has been working with Abcul on a solution and will this year pilot a new product on the market. Among the credit unions involved is the process is Rochdale’s Metro Moneywise, and CEO Ciara Davies discussed the research process behind the pilot.

The team drew on examples from abroad, including the Clean Energy CU in the USA. “They were established about six, seven years ago,” said Davies, “just to provide money for retrofit. A group of people wanting to save the world saw a gap in the ability to access finance to do this work, and decided that a credit union was the perfect model. Six, seven years later, they’ve got $50m worth of loans on their loan book. Demand is through the roof.

“So there is a massive demand for this. It’s not going away – regardless of the scepticism and the challenges, we have to do this, we have to retrofit the cost of gas and electricity.”

Clean Energy’s example shows the value of starting small and working your way up, she said, starting off with basic insulation loans before considering more ambitious projects. But a supportive government policy is also crucial – and in the UK, warned Davies, this is “pretty poor” compared to Ireland or, under Biden’s Inflation Reduction Act, the US.

To rectify this, the pilot project team spoke to the UK Department for Net Zero to advocate for a loan guarantee fund to give credit unions the confidence to enter the market, and policymakers are “up for this conversation”. Another idea is to create a mechanism for members to fund upgrades with a tax-deductible payment direct from their salary; again policymakers are open to discussion but want reassurances around the verification that the work has been done.

Next, the team visited Ireland, where efforts are well under way to develop green loans. Notably, eight credit unions, working together as the umbrella business Collaborative Finance, have developed the Greenify Home Improvement Loan. This collaborative approach to green home finance is “the kind of thing that we want to develop for the UK sector,” said Davies.

“You get the retrofit expertise, you bring it all together, and then credit unions can choose to take this product off the shelf and offer it.”

She added: “This could be a brilliant opportunity to do a national marketing campaign to say credit unions or the green home lender of choice – and done with Greenify is they’ve standardised the product.”

Adding a perspective from Ireland was David McAuley from Donore Credit Union, who said there were initial hitches in getting a retrofit product off the ground, because the information offered to members was too confusing and the initial partners were “commercial organisations not in line with our values”.

“It’s not just about the product,” he added. “We need a holistic approach, we need to see how it fits with our values and what ESG (environmental, social and governance) really means…. At Donore we’re not about pushing loans, we’re about empowerment, so we need to educate members and take them on a journey.”

Members are keen to act but “don’t know where to start”, he added, while the Irish government wants retrofit to progress to help offset emissions from the country’s cattle farms. “The longevity, governance controls, financial processes and member trust of credit unions make them the ideal partner to drive the green agenda,” he said – even more so given the high concentration of credit union membership in Ireland: 3.7million people out of a population of 5 million.

“We’re partnering with like-minded organisations,” added McAuley, “green groups who live and breathe it, and schools looking to demonstrate their green status, putting education and awareness at heart of a wider process.”

Donore has drawn up its own ESG framework, he said, and is “40% of the way along our journey on this” including internal changes such as the installation of solar on its own office.”

The credit union has to assess the energy needs and usage of its common bond, added McAuley, and work out the steps needed to that output over the next 10 years. “What you are doing is drawing people in, demonstrating the benefits, and then they will want the products for their own homes.”

Atkinson added that there is scope for UK credit unions to work wth local councils, which are required to work with a home improvement agency, and with housing providers.

“Landlords were identified in Ireland as a particular issue,” said McAuley. “They are reluctant to engage. Strategic Banking Corporation of of Ireland is working to roll out loans to landlords.”

Davies added: “Credit unions are the best kept secret but the more work we do, the more partnerships, the more people we work with the better – and we’ve got money to lend.”

After discussing their duty to the environment, credit unions were reminded of their role in reviving the UK’s economy, with Dele Adeleye from the Bank of England hoping the country can “see some growth”.

For credit unions, such growth much be accompanied by “safety and soundness”, he said, reassuring delegated that the overall picture of the sector did not give him cause for concern.

He urged members to deal quickly with arrears, and plan for the impact on liquidity now that the PRA has stopped easing. They should also been mindful of a regulatory environment that is growing in complexity, with issues like data risk and climate change entering the picture.

Key to all of this is governance, added Adeleye. “At heart of problems like bad loans, it all goes back to bad governance”, with problems including a lack of succession planning, poor allocation and understanding of responsibilities, the absence of performance assessments, and a reluctance to accept responsibility for unpopular decisions.

The second half of the year will see a supervisory team from the PRA visiting a number of credit unions to assess their governance procedures, he added.

Closing the first day was a speech from Andrew Price, senior vice-president of advocacy at the World Council of Credit Unions (Woccu).

Price warned there are a number of regulatory issues to be aware of, and said the UK sector has to find a way to engage with the EU post-Brexit on issues like cross-border payments and cybersecurity. The international standard setters for the finance sector – such as Basel, the International Association of Deposit Insurers, Financial Action Task Force and the OECD – all sit in the EU, he added.

Outlining Woccu’s engagement with these organisations to ensure proportionality for the credit union sector, to ensure it does not suffer from new rules designed to mitigate the risks of huge multinational banks, he said important concessions had been won from Basel. “I see national regulators around the word missing this and setting those Basel III standards for credit unions,” he warned. “They should not. There are ways you can have simpler systems for credit unions that still meet Basel III.”

Related: Woccu calls for proportionality in digital regulation

Meanwhile, efforts are being made to ensure new anti-money laundering rules do not stop credit unions from improving financial inclusion for marginalised groups or underserved communities

Credit unions will be required to act swiftly to stop cybercrime, said. “If you as a credit union are going to use a third party vendor, how are you going to do due diligence?

“Incident reporting is being standardised across all nations, so everyone can see report, stop contagion spreading from place to place.”

Other priorities include working the the Financial Action Taskforce to ‘de-risk credit unions” so banks do not refuse them finance, and dealing with new sustainability and climate disclosure rules.

“We need to make those rules work for credit unions,” added Price. “When you meet with your policy makers you have to remind them of that. I tell regulators ‘if you don’t do this, you are not going to have the financial services to your people that your governments want’.”

The second day of the conference saw a speech from Andy Burnham, Labour/Co-op mayor for the Greater Manchester Combined Authority, who said the credit union sector had a part to play in “the philosophy of economic localism” that devolution was bringing to UK regions.

Burnham said he was hopeful for an end to a neoliberal, market-led era which has left British people “far too exposed when it comes to the cost of the essentials of life … people on the lowest incomes have struggled badly and that can’t be right in a country like ours.”

For credit unions, this means an opportunity to help local authorities deliver inclusion in energy, housing if these come under local control. For instance, in Greater Manchester, where the bus network is now run by the combined authority, Burnham has made a manifesto commitment to make the Sound Pound credit union consortium an official partner, to deliver an interest-free loan that will allow people to buy annual travel passes up front, and benefit from the discount this brings.

Related: Co-operatives UK co-helms scheme to boost social economy in Greater Manchester

“We will make sure it works for credit unions,” he said. “We will bring more people to your doors and help people get the benefits of a credit union. That will mean people’s weekly travel will be much cheaper than it might have been.”

Burnham said the credit union sector has a role to play in “making sure people on lower incomes can access the benefits wealthier people can”, in relation to his plans for social housing, the green transition, community wealth building and an “Our Business” platform for non-profits.

“We’re pioneering a different kind of economy with a focus on inclusive growth where people grow with the economy,” he added.

If Burnham is receptive to credit unions, this is not always the case with policymakers, and Samantha Beeler, president of the League of Southeastern Credit Unions, gave a US perspective on lobbying.

“With advocacy success,” she said, “we tell lawmakers how good we are, then we do the product, we write the regulation, we tailor the product to the market.

“That’s what UK credit unions are doing now with automobile lending; we’re here to offer help on this.”

In Florida, credit unions have just got the green light from state lawmakers to lend offer money for deposits. “It took us 20 years to convince them that credit unions could handle this business,” she said. The change was given a push by Republican state governor Ron DeSantis, a reminder, said Beeler, of the importance of a non-partisan approach. “We are not right, we are not left, we are credit union,” she said.

It’s important to tell stories and show data of the positive impact credit unions bring, she added. “If you start asking lawmakers for favours you’re no different from anyone else. If you say ‘we do this, do you want to be a part of it,’ that makes a difference.”

As cybercrime and fraud becomes more serious – with one of the league’s credit unions losing $2m in a week – credit unions also have to work with state and federal law enforcement. “You need to tell lawmakers those stories,” said Beeler, “it’s not enough to say ‘we need help with fraud’.”

The final speaker also hailed from the States – Sandra McDowell of the CU eLeadership Academy, who discussed inclusive leadership which, she said, s vital to the functioning of an organisation, adding: “With inclusive cultures we need to think about how we move to a place where we think as ‘we’.”

This delivers benefits in terms of reducing employee burnout and stress, improving productivity and profit, and eliminating confirmation bias from decision-making, she said. “When you get more perspectives together it brings better thinking: 80% of job applicants are looking for diverse place to work.”

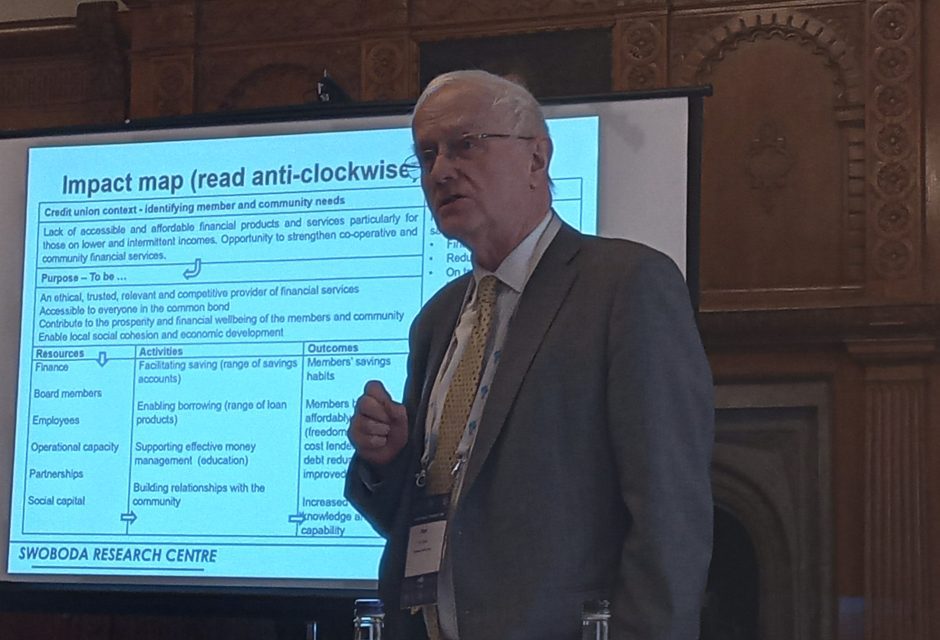

A series of breakout sessions wrapped up the conference, including a presentation on social impact reporting from Paul Jones and Nick Money of the Swoboda Research Institute, which offered a useful postscript to the two days’ of discussion of community development.

Social impact reporting is “about showing the credit union difference”, said Jones. Done right, it can “inspire members, recruit members and influence stakeholders,” he added, especially with new trend for ethical consumerism and ethical finance. But “it’s not just about marketing, it’s about learning how we can improve year on year. Social accounting is not just a one-off.”

A methodology is needed for this reporting: Jones advocates the “theory of change”, a causal model of an organinayion’s work which is widely used by charities and social enterprises. By linking activities with sought outcomes, it creates an “impact map”.

For credit unions, “we want people to be financially better off, have less financial stress, have better access to services, be better able to deal with the unexpected. How do we measure it?”

Money said one aspect of this is social return on investment (SROI) reporting: for instance, an organisation that invests £1m in taking people out of unemployment can demonstrate the number of people helped and the amount saved in benefits. But this should not compromise the central purpose of a credit union – “looking out for the financial wellbeing of our members” – he warned.

Panelists from three credit unions shared their experience of social impact reporting. Chris Canham from Hoot CU, in Bolton and Bury, said this could be as simple as looking at the amount of interest members save by opting for a credit union and multiplying this by the number of loans.

Emma Norldge, from Wave Community Bank, based in the south-east, said: “During the pandemic we decided to do social impact reporting separately. We had partnerships with councils coming up for renewal, we were looking for partnerships with payroll employers, and we wanted story to tell.”

She advised credit unions to keep details of “each time you do something good … so when you come to do the social impact report 80% of your content is there,” and urged them to hire good designers who know who to highlight the headline figures. And to avoid repetition of detail and highlight innovations, she suggested making reports on a two-yearly basis.

“We’ve had a lot of back and forth to get the right data,” said Danny Peers from Enterprise CU, one of five credit unions on Merseyside taking part in a Fair4All report on the social impact of credit unions. “We’ve had interviews with staff, senior management, directors, members … plus 1,000 completed surveys. We felt this was an opportunity to reaffirm what we believe we do, and also an opportunity to document staff perspective and the perspective from the members.”

Related: Filene looks at potential of text generative tech

Together, the five credit unions serve 55,000 members on Merseyside, with a £35m loan book and £50m in savings. The study found that their loan products save over £23m in interest – putting that money back in members’ pockets. “More than 80% said that membership had positive impact on their finances and also their mental and physical health,” said Peers.

From the audience, Donore’s David McAuley offered his own experience. “The “internal dynamics delivered to the board, members and staff was huge. It repurposed the credit union and took us back to what we’re really good at – what our mission is on how we serve our members’ needs…. We’ve seen improved membership, improved financial stability, growth in our services, growth of our loan book, and we’re now a more sustainable credit union.”

In the UK, social impact reporting can also help with regulators, said Nick Money. “How are we going to evidence that a credit union is a CDCU? A civil servant at the other end will want proof; these are the kind of activities that show us how to get there.”

This will become more crucial still once reporting on ESG or the SDGs enters the picture. “Barclays has to report to the government on carbon in lending,” said Money. “We aren’t required to do that but we will be. At some point we have to show we are the good guys.

“Barclays and Lloyds have to show their impact, and they are doing good stuff in our communities, and have marketing teams to tell people, so we have to answer that.”