Ecology Building Society is one of the founding signatories of the United Nations Principles for Responsible Banking, a global initiative to align banking business with the Sustainable Development Goals and the Paris Agreement on climate change.

An ethical finance pioneer, Ecology specialises in environmental lending for properties and projects and supporting sustainable communities.

It is the first building society to sign the principles, and joins a coalition of 130 banking providers worldwide, representing over US$47tn in assets, in committing to working towards a sustainable future.

Ecology chief executive Paul Ellis said: “Given the scale of the climate and ecological crisis, we need finance that serves people and planet. The principles have the potential to drive systemic change, ensuring that the purpose of banking extends beyond profit to creating positive social and environmental impacts.

“Signing up to the principles wasn’t a difficult decision for Ecology as we’ve been acting as pioneers of environmental finance since we were established. We’re proud to support these concerted efforts to build a sustainable future.”

Other signatories include Dutch financial and banking co-operative Rabobank, European ethical banking specialist Triodos, Canadian credit union federation Desjardins, Costa Rican credit and services co-op Coopeservidores, and French co-op bank Credit Agricole SA.

The launch of the principles, at the start of the UN General Assembly, marked the beginning of the most significant partnership to date between the global banking industry and the UN.

“The UN Principles for Responsible Banking are a guide for the global banking industry to respond to, drive and benefit from a sustainable development economy,” said UN secretary general Antonio Guterres at the launch event in New York. “The principles create the accountability that can realise responsibility, and the ambition that can drive action.

“A banking industry that plans for the risks associated with climate change and other environmental challenges can not only drive the transition to low-carbon and climate-resilient economies, it can benefit from it,” said Inger Andersen, executive director of the United Nations Environment Programme (UNEP).

“When the financial system shifts its capital away from resource-hungry, brown investments to those that back nature as solution, everybody wins in the long term.”

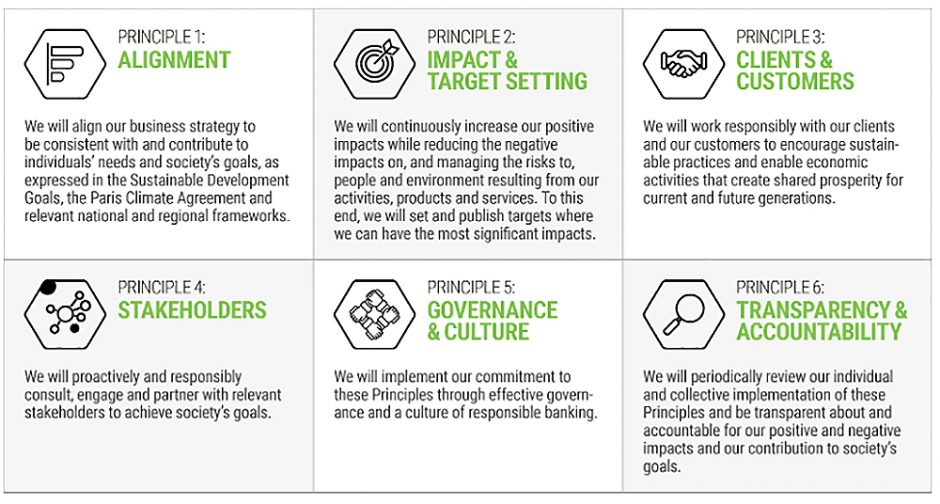

The Principles for Responsible Banking are supported by an implementation and accountability framework. By signing them, banks commit to being open and transparent on both their positive and negative impact on people and planet and setting ambitious targets in line with global and local sustainability goals.

They were developed by a core group of 30 founding banks through a global partnership between banks and the UNEP Finance Initiative, a UN-private sector collaboration that includes membership of more than 250 finance institutions around the globe.