If you ask a business owner if they would like to make more money the answer is usually “Yes”, followed swiftly by “but what’s the catch?”

The default, competitive, market has bred a naturally suspicious mindset, which typifies an economy built on competition, scarcity and exclusion.

Overcoming suspicion and building trust are the core tasks of the Open Credit Network, a new mutual credit project developing a network of forward-thinking businesses which are seeding a more collaborative economy.

What is mutual credit?

Mutual credit is not a new idea – most people have heard of LETS (Local Exchange Trading Systems or Schemes) in which people exchange goods and services without the need for money – but business-to-business schemes are not so common.

Mutual credit provides a mechanism for businesses to trade without money, via a credit clearing system. This is an arrangement through which a group of businesses, each of whom is both a buyer and a seller, agree to allocate each other sufficient credit to facilitate their transactions within the network.

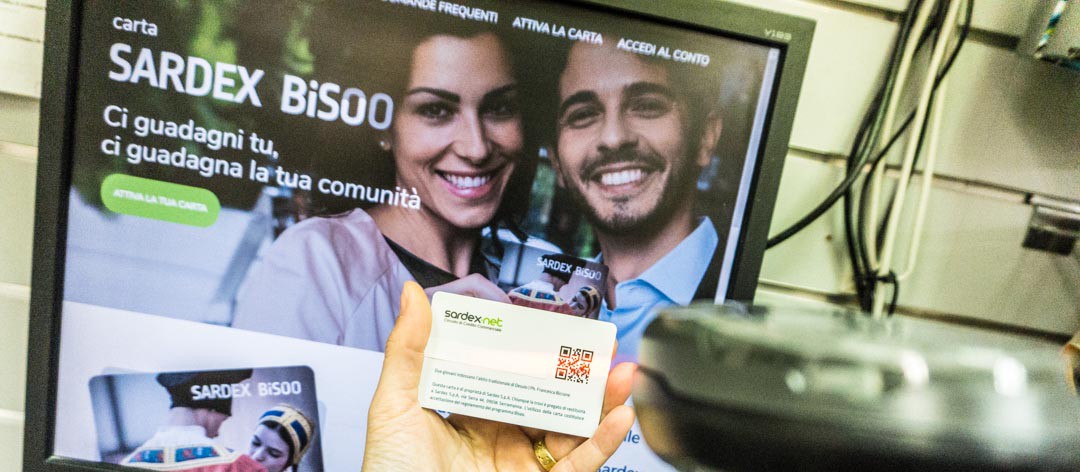

There are some significant examples of existing mutual credit schemes. The WIR for example, has been increasing the turnover of Swiss businesses since 1934. The Sardex network in Sardinia is also very well established and facilitated over €41m (£35bn) worth of trades for its members in 2017. These, and examples in other countries, prove that when enough people agree to collaborate it is perfectly possible to conduct business and generate increased profits without the need for conventional ‘money’.

How does mutual credit work?

- Businesses that join the network offer goods and services to other member businesses in exchange for credits, at the same prices they charge in their regular currency.

- Businesses receive an interest-free line of credit enabling them to trade with other members of the network without needing cash.

- Each business is listed in a directory of “offers and wants” enabling other members to find the goods and services they need, and to find new customers and suppliers.

- Trades are conducted in credits or a ‘blend’ of traditional (fiat) currency and credits – to ensure businesses are able to cover the costs of raw materials and other necessities which are not available in credits, and cover their tax liabilities, because VAT is still payable on mutual credit trades.

- The buyer’s credit balance goes down – the seller’s balance goes up – the overall balance of the network remains at zero at all times.

What are the benefits of mutual credit?

There are multiple benefits of using mutual credit – which, just to clarify, is not an alternative currency (since there is no “currency”) or a tax avoidance scheme. The main benefit is the ability to turn spare capacity into additional revenue and profits.

Take Mrs Pie’s restaurant as an example. Mrs Pie has a number of fixed costs: ingredients, pie chef, waiters, rent, rates and utility bills. No matter how many pies she sells she still has to pay these costs. If only 20 of the 30 tables in her restaurant are full the other 10 tables are her spare capacity. They are not generating any income while they sit empty – they are dragging down the profit margin of her business.

Now, suppose Mrs Pie joins the Open Credit Network, and agrees to receive credits in exchange for pies at 10 tables. She will encourage customers who may not have cash, but do have credits, to eat in her restaurant. If she fills all the empty tables with credit-paying customers she has ‘optimised’ her business by turning her spare capacity into revenue. Now she can spend the credits she received to buy supplies for the restaurant with other businesses in the network. She might buy ingredients, drinks, or pay her accountant or hairdresser in credits, for example.

If Mrs Pie’s cash-flow is not looking great she could even buy goods and services from the network before taking a single credit, by using her interest-free ‘overdraft’ in the mutual credit system. This is second benefit of the network.

So, thanks to the Open Credit Network, Mrs Pie has optimised her business: she has generated more revenue, which has in turn increased her profit margin. Plus, she’s probably made a few new friends along the way by accepting credits at her restaurant and trading with other network members.

But the benefits don’t stop there. Being part of the Open Credit Network helps grow a business’s customer base via the directory, where they can promote their goods and services to other participating businesses.

Being listed in the directory makes a business a preferred supplier if another business needs a service and can only pay in credits.

Accepting mutual credit also avoids discounting, which undermines profits, and frees up precious liquidity (cash in the bank) for essential purchases. The interest-free credit limit can be used to cover running costs or to fuel expansion to help a business grow.

Mutual credit schemes also consistently report increased loyalty, and stronger and more supportive relationships with other members. The reciprocal, collaborative nature of the network changes the fundamental nature of trade. Members are united through the network, rather than divided and extorted by the conventional banking system which has monopolised the creation of money for too long.

The co-operative advantage

The Open Credit Network is being developed as a not-for-profit co-operative and is being championed by the Finance Innovation Lab. If your business is interested in getting involved you can express interest and will be invited to join as a member when the admin team have found you potential customers.

As far as we are aware, there is no other co-operatively owned, business-to-business mutual credit system in the UK, making the Open Credit Network unique.

Being governed by its members and following the co-operative principles means the primary purpose of the Open Credit Network is to serve our members, the businesses which trade in the network. Other networks claim to have similar purposes, but as privately owned companies, often backed by venture capital, these organisations will never be able to compete with the co-operative alternative. They will always be conflicted by the desire to make a profit for their owners, investors and shareholders, which can only ever be delivered by extracting value from the members of network.

First trades

Having gathered expressions of interest from hundreds of UK businesses and co-ops the Open Credit Network has now completed its first trades – validating the idea and the trading system. The first trading loop involved Lowimpact.org, Community Regen and Outlandish, two of which are co-operatives.

Here’s what Paul, of Community Regen, said about the trade:

I can see transactions that don’t involve money becoming very attractive for small businesses, who often have problems with cashflow. It builds trust between participating businesses, which just makes sense to me. It’s a no-brainer, really.

And here’s Polly at Outlandish:

It feels great to be right at the start of a network designed to facilitate trade outside of the normal realm of monetary exchange. It’s great that like-minded businesses can be connected in this way, without having to contribute to banks’ profits. Hopefully it will also help us to extend our network of suppliers, and to find suppliers that operate ethically. I found the trade itself really easy.

And here’s Dave of Lowimpact.org:

We’ve started to get good advice from Paul, and we’ve already lined up a second trade with an accountancy firm in which we’ll use mutual credit as part of the payment for producing our annual accounts. Using mutual credit feels like a much better way to do business, which makes me believe that there is huge potential here for bringing about wider, beneficial change.